Membership

Insurance

Our Insurance Has You Covered

As a Pedal Power ACT member, you’re protected with our bike riding insurance, designed to support you if you’re injured while riding or taking part in an approved Pedal Power ACT activity.

We’ll help cover non-Medicare medical expenses if you’re injured while riding or taking part in a Pedal Power ACT activity, including physiotherapy, chiropractic treatment and hospital care, and all claims require supporting documentation.

If you’re injured while cycling and unable to work, you may be eligible to receive up to 85% of your weekly income for up to 52 weeks, subject to policy conditions and a short waiting period.

If you accidentally cause injury to someone else or damage their property while riding, you’re covered for up to $5 million. You’ll only need to pay the first $1,000, and the policy takes care of the rest.

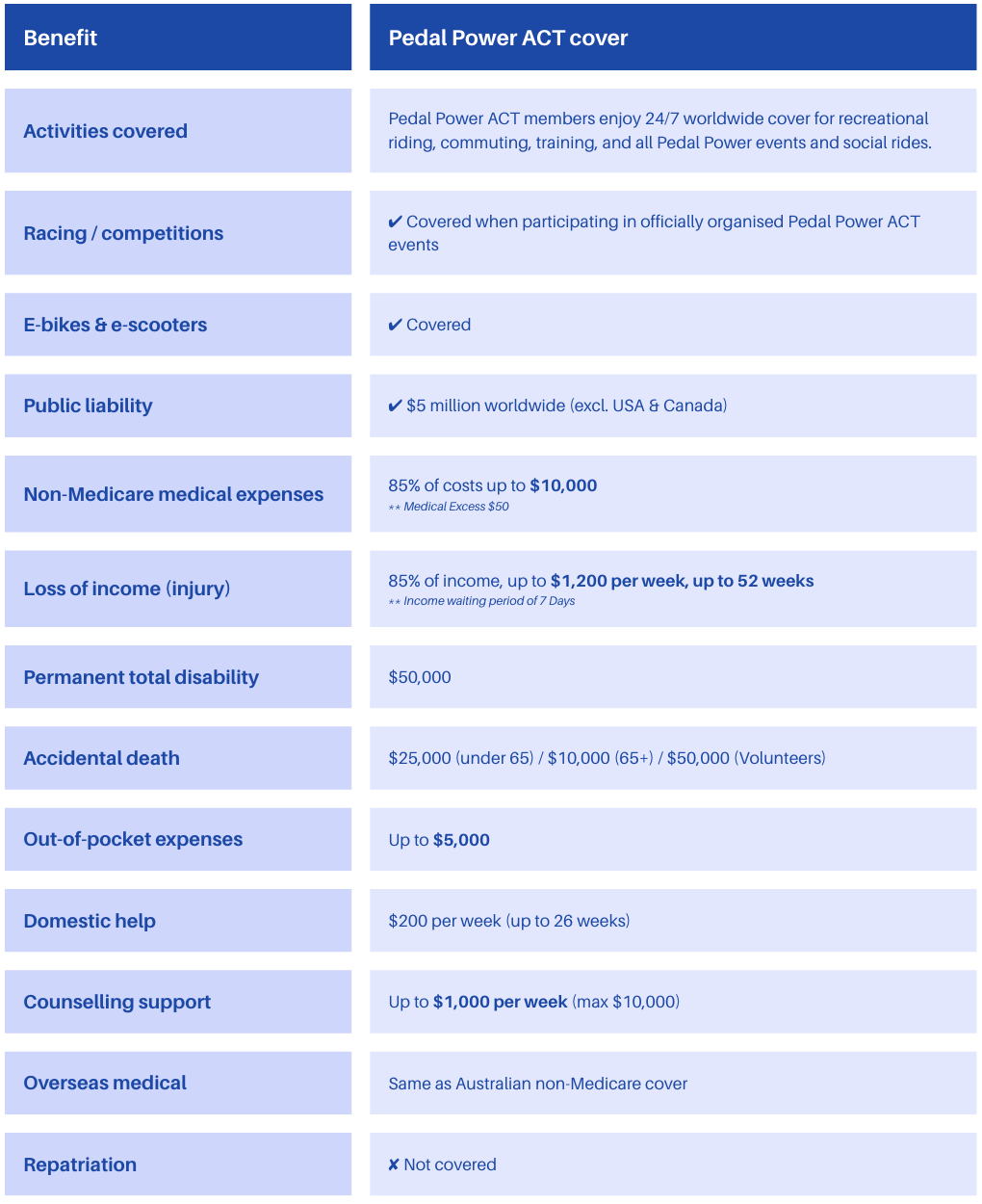

What your Pedal Power ACT insurance covers at a glance

This is a summary of the policy provided as a guide only. This information is not intended to provide a comprehensive overview of the cover available under the policies. For full details, please refer to the supporting Pedal Power ACT insurance policy documents for full terms, conditions, and limits.

Not a Member? Join today and get covered!

Membership

FAQs

Here are the answers to your most common questions.

If your question isn’t in the list, please get in contact with our insurer Enrizen

via phone +61 2 8316 3950

via email: info@enrizen.com,

Or you can visit www.enrizen.com.au

-

Start by completing a Personal Claim Form.

Download the form here

Complete all sections and attach supporting documents

Email the completed form to office@pedalpower.org.au

Pedal Power ACT will review the form and assist with submitting your claim to the insurer.

If your claim involves third-party injury or property damage, contact Enrizen immediately and do not admit liability.

-

To help you plan with confidence, it’s important to know what falls outside the scope of cover:

Damage to or loss of bicycles and cycling equipment

Personal belongings

Racing or competitive events (unless officially organised by Pedal Power ACT)

Riding for business or courier purposes

Riding an illegal or non-compliant bike.

This includes riding an electric bike that does not meet ACT legal requirements.

Not sure if your e-bike is compliant? Check our simple guide here.

For full peace of mind, we strongly recommend arranging separate insurance for your bike and equipment, especially if you ride frequently or own high-value gear.

-

Yes!

Pedal Power ACT members are covered 24/7 for overseas cycling incidents while riding recreationally or commuting, subject to policy limits and conditions.

Please note that this cover does not apply to competitions, races, or organised competitive events, and public liability cover is excluded in the USA and Canada.

As this insurance is not a substitute for travel insurance, we strongly recommend taking out comprehensive travel insurance before riding overseas.

-

No.

Our insurance is designed to support riders if they’re injured or involved in an incident, with cover for personal accident and liability.While it doesn’t cover bike damage, theft, or personal belongings, it provides peace of mind where it matters most: your safety.

-

Yes.

You must be a current Pedal Power ACT member to be covered by insurance while participating in Pedal Power ACT rides, events, and activities.Some events may allow non-members to participate, but insurance cover will not apply unless you are a member.

-

A $50 medical excess applies to each personal accident claim made under the policy.

This means you are required to pay the first $50 of eligible medical expenses before the insurance benefits are paid.The excess applies once per claim, not per treatment or appointment.

All benefit limits, conditions, and eligible expenses are outlined in the Personal Accident Policy Schedule, which should be read together with the policy wording.

-

Your insurance cover begins once your Pedal Power ACT membership payment has been received and remains in place until 11:59 pm on your membership expiry date.

To ensure you remain covered without interruption, please renew your membership before it expires.